Euro Area: can recession tame inflation?

We are in a market context where bad macro news can be good market news. This was the case for the US this week after the JOLT’s labour survey showed the first signs of weakness in the US jobs market, rekindling hopes of a possible Fed pivot. The recession-level of economic indicators published this week for the Euro Area, however, did not have the same impact. Energy prices, euro weakness and sluggish labour market dynamics in Europe mean that we cannot expect inflation to adjust as rapidly to a contraction in GDP or an increase in the unemployment rate.

Recession-level economic indicators

The final composite Purchasing Manager’s Index (PMI) published this week for the Euro Area fell to 48.1 in September (from 48.9 in August, just below the consensus 48.2). This below 50 reading indicates that activity in the Euro Area weakened considerably in Q3, with the exception of the noteworthy resilience in French services activity.

- At a country level: the composite index in Germany fell to 45.7 (from 46.9), while in France it rose to 51.2 (from 50.4 in August). Finally, in Italy the composite index fell further to 47.6 (from 49.6 in August), while the PMI in Spain slipped into contraction mode at 48.4 (from 50.5 in August).

Despite supply chain bottlenecks easing, allowing firms to work through large production backlogs, soaring energy prices have plummeted manufacturers’ expectations for future output. We expect to see a mild contraction in GDP as of Q3, cushioned by the impact of a booming tourism season and followed by two quarters of mild recession, with harsher downturns in countries more exposed to the energy crisis in Eastern Europe and Italy. Social buffers should limit the impact of the energy crisis on households, while investment will take longer to recover without improved visibility.

Euro area inflation no longer just an energy story

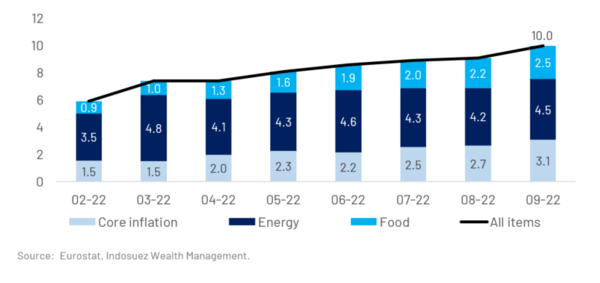

- According to Eurostat’s preliminary estimates last week, inflation in the Euro Area reached 10% year-on-year in September.

- Prices also progressed on a monthly basis by 1.2%, its sharpest rise since March 2022.

- Energy prices (up 40.8% YoY) and food prices (up 11.8% YoY) continue to drive the acceleration in inflation. However, more worrying for the ECB, is the apparent pass-through to other prices.

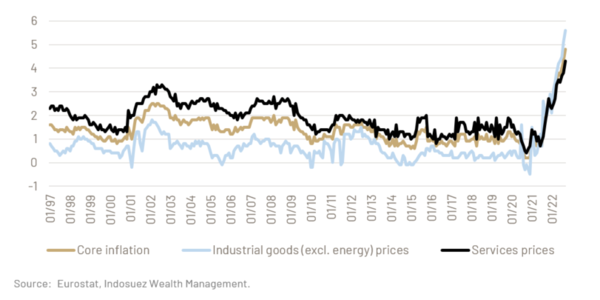

Core inflation (excluding volatile prices from energy, food, tobacco and alcohol) has indeed risen to its highest YoY rate on record (at 4.8%), driven by both the rise in non-energy industrial goods and services (Chart 1) - Looking at national statistics, it is important to underline that the fuel discount and the "9-euro ticket" for public transportation that had maintained German inflation artificially low, have now expired, adding to pressure on German consumer prices (also up 10% YoY in September). Inflation now ranges from 6.2% YoY (in France, helped by energy price shields) to 17.1% (in Netherlands).

Inflation will remain high, despite the mild recession

Looking ahead, it’s not all grim on the European growth front, which should prevent a prolonged recession from this energy crisis, but we keep our scenario of 2 or 3 quarters of recession. The NextGen EU programme has already been released to member states and public investment is on the rise. The strong inflow of people from Ukraine is increasing the European workforce, notably in Germany and Poland, and there is growing policy support to deal with the energy crisis and shield consumers.

Energy prices should hold up inflation in the winter, and lose steam by early 2023.

- First, even if oil prices should recover from current post-pandemic lows (of USD 80 per barrel) given OPEC’s reinforced supply cuts and a rebound in Chinese demand, they should moderate on a YoY basis going in 2023.

- The damage from gas supply uncertainty is only just beginning to effect growth, but the impact of gas prices on inflation should slow in the absence of any additional stress on gas supply. Gas prices have already fallen almost 40% over the month of September, remain still 40% higher than 31 December 2021 levels.

- Finally, efforts to cap the rise in electricity prices currently under discussion at the EU level, as well as significant base effects a year after the Ukraine crisis set-off, should reduce the direct pressure of energy prices on consumer price inflation going into 2023. But clearly, and compared to the US, the main risk of energy prices in Europe comes from a highly volatile wholesale electricity price with strong correlation to gas prices.

Nevertheless, total inflation will remain high for longer due to the lagged energy price pass-through effect on other prices and the impact on wages.

- Core inflation dynamics are expected to take over from energy prices; in 2023 core inflation could surpass headline inflation.

- The contraction in activity is not expected to lead to a massive reduction in employment. Therefore the impact on wages should be more modest. Wages rose by 4.1% in Q2 compared to Q2 2021 in Europe (after in 3.7% in Q1 and 2.2% in Q4), with albeit important sector divergences between industry (2.7%), construction (4.1%) and services (4.9%). Eastern European countries have led the rise in wages as well as Germany (up 5.5% in Q2, with services up 8.2%). Labour costs rose by almost 6% in Belgium where wages are indexed to inflation. In real terms (correcting from inflation) wage growth in the Euro Area remains negative. Thus far, the unemployment rate remains stable at a historical low of 6.6%. In Germany, vacancies remain 10% higher than pre-COVID levels despite the inflow of refugees. Parts of the German iron and steel industry in IG Metall have received a wage increase of 6.5% across 18 months that also includes a EUR 500 one-off payment. Wages are expected to continue rising in the Euro Area in 2023.

- Inflation inertia. Historically wages have been sticky in Europe due to labour market rigidities, longer duration of wage agreements and a high share of SMEs . Although wages have thus far risen significantly less than in the US (6.7%) or the UK (5.5%) where wage indexation to inflation is more prevalent, any increase in wages in the Euro Area will be costly to undo given the rise in unemployment needed to reduce wages in Europe compared to its peers. Furthermore, after one month of easing, both market and consumer survey inflation expectations are once again on the rise. The longer it takes to tame inflation, the higher the risk that wage-setting processes could result in greater inflation differentials across countries. For this reason, policy makers in Europe favor preventing the increase in wages and focus on limiting energy prices. Wages although published with a significant lag in Europe, will be a key metric to follow in the coming months.

- Although the pressure from energy prices is expected to weaken, import prices will be higher for longer stemming from logistical prices of LNG imports permanently increasing and weighing on the trade balance, adding to euro weakness. Furthermore, energy is purchased in USD.

Key investor takeaways

- Although inflation has been above the ECB's target since July 2021, rate hikes did not commence until a year later. Faced with inflation expected at 5.7% in 2023, the ECB will accelerate rate hikes. At the beginning of October, the markets were anticipating key rates at 1.95% by the end of the year and 2.17% by September 2023.

- Sluggish labour market dynamics in the Europe mean that we cannot expect inflation to adjust as rapidly to a contraction in GDP or an increase in the unemployment rate. Markets will be more sensitive to macro data in the US in coming months.

- If we do not have further scares on gas supply in Europe, we do have reason to believe that there will be a recovery in growth in H2 2023. Disinflation, further acceleration in wage income, and policy support to the economy should support GDP starting in second-quarter 2023.

- The scars of the crisis will, however, be visible as euro’s macro-imbalances will deepen, notably with a significant rise in public sector debt and trade balance deficit. This is a long term negative for the EUR. Investors should also start to recognise the impact on corporate earnings, after several quarters where either energy shields or hedging strategies have postponed or reduced the impact of rising energy prices.

Chart 1: total inflation (YoY, %) and conributing factors (% point contribution to YoY growth in prices)

Chart 2: core inflation (YoY, %)

October 07, 2022