Natural gas prices skyrocketing and the energy crisis: what to expect?

For several weeks now, the market seems to be increasingly concerned about the consequences of the ongoing energy crisis in Europe and Asia, and to a much lesser extent in the United States.

With natural gas prices soaring (futures contracts listed in New York are +115% since the beginning of the year), pressure has increased on consumers, forcing some European governments to act via the implementation of a tariff shield on electricity prices. Spain wants to redistribute the profits of gas and electricity companies to households, Italy has announced EUR 3 billion support to cushion the surge in prices while France has opted to distribute energy vouchers to block gas prices until April after the recent 12.6% increase. While households are being hit hardest by this increase which could potentially alter future consumption particularly in the run-up to Christmas shopping, it also raises doubts about its impact on the results of certain companies and more generally on global growth.

Limited supply and replenishment of stocks

But first, let's look back at the main reasons that led to this situation:

On the demand side:

- The cold winter in Asia in early 2021 has led to increased demand for liquefied natural gas from China even as authorities reportedly recently asked state-owned energy companies to ensure they have sufficient energy reserves to weather the winter, no matter what the cost. At the same time, environmental constraints on coal mining, which provides 60% of its electricity production, has also exacerbated buying pressure from the Middle Kingdom.

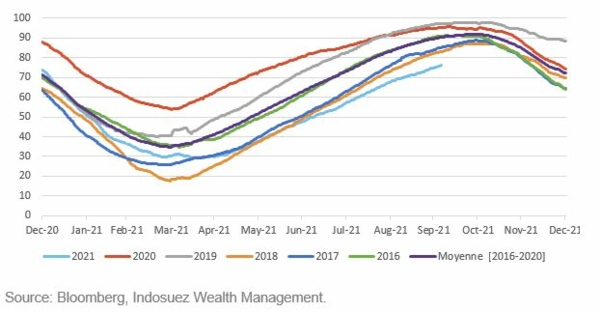

- In Europe, the same reasons have the same consequences. While the cold winter had reduced gas inventories, some countries are now seeking to rebuild their stocks but are facing certain difficulties. Gas reserves are at their lowest level for this period (75%) for the last five years (5-year average at 90%, see Chart 1).

Chart 1: Gas stocks in Europe are at their lowest levels in this period, compared to the last 5 years (in % of total capacity)

- Generally speaking, this price increase is simply a reflection of the boomerang effect of a global economy that has recovered strongly after a year where economic activity has been constrained by the pandemic in 2020. One of the examples that illustrates this is the rebound in China's electricity consumption by more than 20% and 10% in the first and second quarter of 2021 year-on-year respectively.

On the supply side:

- Over the past few years, the green transition has accelerated the dependence of some countries on renewable energy however, this has been intermittent. Weaker winds in the United Kingdom, where wind power accounts for more than 20% of electricity production, has led to a shift in demand towards natural gas.

- A tense geopolitical context has also weighed on gas supplies in Europe. Algeria, Spain's main supplier of gas and whose relations with Morocco have deteriorated, is threatening to close the tap on its gas pipeline passing through the Cherifian Kingdom at the end of October. Although the other pipeline, the Medgaz, could be an alternative solution for supplying the Iberian Peninsula and Italy, its capacity remains more limited. Finally, the tensions between Russia and Ukraine as well as the debates around the controversial Nord Stream 2 have certainly been a catalyst for the lower gas supply from Russia.

What effects should we expect at a micro and macroeconomic level?

This combination of factors has unbalanced the supply-demand balance in the natural gas market, with consequences for other sectors of the economy.

As a result, other commodities have also witnessed increased. Operators are looking to switch their energy production to coal and oil, which partly explains the 30% and 8% increases respectively in these fossil fuels in September, while OPEC+, against the expectations of some analysts, has decided to stay with its baseline scenario and only increase its production by 400,000 barrels per day. The price of carbon credits but also of electricity have jumped (+60% in September for futures on the Phelix Base)

This price increase threatens certain sectors. On the one hand, government proposals, such as in Spain, could affect the profits of energy companies where for all assets whose production price is not impacted by gas prices, 90% of their excess profitability beyond EUR 20/MWh could be taken back by the Spanish authorities. According to UBS, these measures could cost between USD 5-10 billion for the sector as a whole, depending on gas price levels and government measures. However, for now the cost of such actions seems be too high in view of the Spanish authorities who are softening their tone on the proposals. On the equity markets, an average gas price of EUR 100/MWh until 31 March 2022 could decrease Iberdrola and Endesa’s stock prices by 3% and 6% respectively, a level however lower than the correction observed on the market in recent weeks.

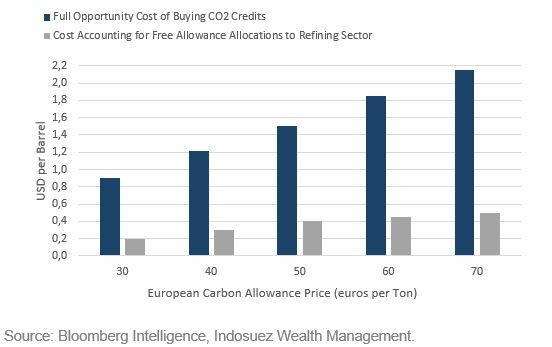

On the other hand, the rise in carbon prices is likely to increase refiners' costs by 45 cents to USD 1.85 per barrel, affecting the margins of the refining segments of Total, Repsol and Shell, according to a Bloomberg report (see Chart 2). However, this amount is more than compensated by the increase in profits in the upstream sector for integrated companies such as Total, whose profits could rise by 18% in 2022 if gas market conditions remain as they are next year, according to Goldman Sachs’ forecasts.

Cement and steel producers could also be affected by this price increase and more generally sectors with a high weight of energy expenses in their cost base, such as aviation and transportation. A Bank of America report notes, for example, that cement manufacturers whose coal accounts for 75% of their electricity and fuel costs, and diesel for 40% of their transportation costs, could see their margins shrink by 100 basis points if the cost of these two raw materials rises by 5%, i.e. a final impact of 3.5-4.5% on EBITDA.

Chart 2: A rise in the price of carbon credits likely to have an impact on refiners' margins

Finally, from a macroeconomic point of view, this energy crisis casts doubt on the pace of growth in certain countries, particularly in China, where some factories have been forced to close, partly because of the rise in energy costs. Morgan Stanley estimates that if production cuts linked to energy costs persist, GDP growth could be impacted by 1% in the fourth quarter. The same is true in India, where low coal inventories are threatening to bring economic activity to a halt for some manufacturing companies. In Europe, the United Kingdom, Italy, Spain and Germany could be the most affected (with on average more than 70% of primary energy consumption coming from fossil fuels). Conversely, France, whose energy mix is oriented towards nuclear power, and Switzerland, will probably be spared.

What to watch for in the coming weeks?

According to the futures markets, the price peak for natural gas is expected in February 2022 before returning to more normal levels between March and April next year (see Chart 3), at the end of winter.

However, while recent short squeezes have exacerbated the rise in prices, some news could change the forward structure of prices.

Chart 3: Term structure of natural gas futures (GBp/therm)

Among other things, Vladimir Putin's announcements seem to show that Russia could unblock the situation in the short term even though the construction of Nord Stream 2 is officially finished. While the pipeline still has to pass technical tests and certification, Alexei Miller, Gazprom's chief executive, has said that the group could be supplying gas to Europe by the end of the year. In this context, it will be useful to monitor whether there is an inflection in the flow of raw materials arriving at the Mallnow terminal in Germany, which has fallen sharply since last July.

Finally, and most importantly, weather data should be closely monitored. While some analysts believe that the market may already be pricing a high-risk premium to prepare for a harsh winter, a less than expected pronounced drop in temperatures could calm buying pressure.

In the longer term, it should be noted that this energy crisis raises the question of Europe's energy mix in a more structural sense – a question of competitiveness as much as of strategic and geopolitical autonomy, especially when we know that global demand for electricity could grow by more than 50% by 2050 and that 9% of this demand would come from electric vehicles. While the recent health crisis and natural disasters have at least had the benefit of accelerating ecological transition projects, they have also highlighted the growing need to increase investment in this area to meet energy demand, which is set to accelerate in the coming decades.

October 15, 2021